Join AgroFides on the Great Reset

Prince Boateng

2021-06-28 12:00:00

On the heels of the COVID-19 pandemic, a crisis that touched the lives of nearly every person on this Earth, we step into a new era - or at least, the opportunity to do so. The past year and a half unveiled no shortage of inadequacies in ‘the system,’ within which lies a complex, intertwined, yet woefully disharmonious mesh of institutions of governance and players in health, finance, technology, and countless others. Status quo fell flat on its face. Convention failed to rise to the challenge. ‘The usual’ could not adapt to newer times. Whether we as a society decide to take the next, arguably long overdue, step to reimagine the economy and the practices that shape it or simply hit the back button to what once was, is in our hands. This call-to-action for change has widely become known as the Great Reset.

According to Klaus Schwab, founder and executive chairperson of the World Economic Forum, the Great Reset agenda involves three overarching components : 1) steer markets toward fairer outcomes, 2) ensure that investments advance goals like equality and sustainability, and 3) harness the innovations of the Fourth Industrial Revolution to support the public good, especially by addressing health and social challenges. AgroFides is the embodiment of these ideals that will propel the world into this new age. We intend to be the vanguard of this movement - an agent of social good, innovation, equality, and sustainability.

The first aim that Schwab outlined was steering markets toward more equitable outcomes. Despite performing the vast majority of the work in the sub-Saharan African agricultural sector, farmers (particularly smallholder farmers) are among the most economically marginalized, earning less revenue compared to others in the agricultural value chain. Though there are several explanations for this, perhaps most paramount of all is their inability to secure credit. 90-95% of farmers in Sub-Saharan Africa cannot secure credit or loan services, primarily because creditors currently don’t possess reliable tools to assess the creditworthiness of farmers (again, especially of the smallholder kind). AgroFides’ Fides Score allows creditors/lenders to determine the creditworthiness of small and medium-scale farmers by examining characteristics of the individual in question and the farmer's environment. Coupled with our various agricultural extension/support services, we will shift sub-Saharan African agriculture from a cash-based to a credit-based economic system. AgroFides will play an integral role in elevating the economic status of farmers we work with and break them out of the marginalization that the former system had them under.

Schwab also emphasizes the need to ensure that investments promote shared goals such as equality and sustainability. He writes, “Rather than using these funds, as well as investments from private entities and pension funds, to fill cracks in the old system, we should use them to create a new one that is more resilient, equitable, and sustainable in the long run.” AgroFides provides our lender customers the opportunity to not only make the aforementioned economic impact for these farmers but to also receive measurable social and environmental impact returns on their loans. The capital that our lenders invest is allocated toward the shared goals that Schwab underscored.

On the environmental side, climate change inflicts harsh conditions upon rural smallholder farmers. These family farms are largely rain-fed and lack irrigation infrastructure, therefore are climate-sensitive and vulnerable to droughts or flooding. In fact, floods & droughts wash away these farmers’ investments every second or third year . Furthermore, climate projections predict declining or differing rainfall amounts, rising temperatures, and frequent droughts, increasing the likelihood of crop failure. Consequently, farmers will need investment capital to combat the strain induced by climate change. Smart agricultural systems (e.g., raised beds), crop diversification, and flood and waste management infrastructure are among the ways farmers will use the loans they receive, thus increasing their resilience to weather events.

A significant component of the social impact that lenders’ investments make is promoting gender equality in sub-Saharan African agriculture. Female farmers face several barriers to accessing loan and agricultural support services. These include exclusion from cooperatives, being pushed out of planting cash crops that are more credit-eligible than subsistence crops, and lack of ownership of the land they farm on. Through AgroFides, lenders can lend to female farmers, closing the gender gap.

The last element of Schwab’s vision for the Great Reset is to take advantage of the innovations of the Fourth Industrial Revolution to support the public good, especially in the health and social arenas. AgroFides was born out of the digital revolution. Our peer-to-peer lending platform, electronic agricultural extension services, and credit scoring algorithm drawing data on areas from agronomic surveys to crop budgets to insurance histories - all of this is a product of the Fourth Industrial Revolution. Moreover, Schwab notes that the collaboration between companies, universities, and other parties during the COVID-19 crisis should serve as a precedent for the post-pandemic era. We at AgroFides are committed to fostering partnerships and have already teamed up with public and private sector partners including UN Agencies, NGOs, universities, and other AgTech and FinTech startups.

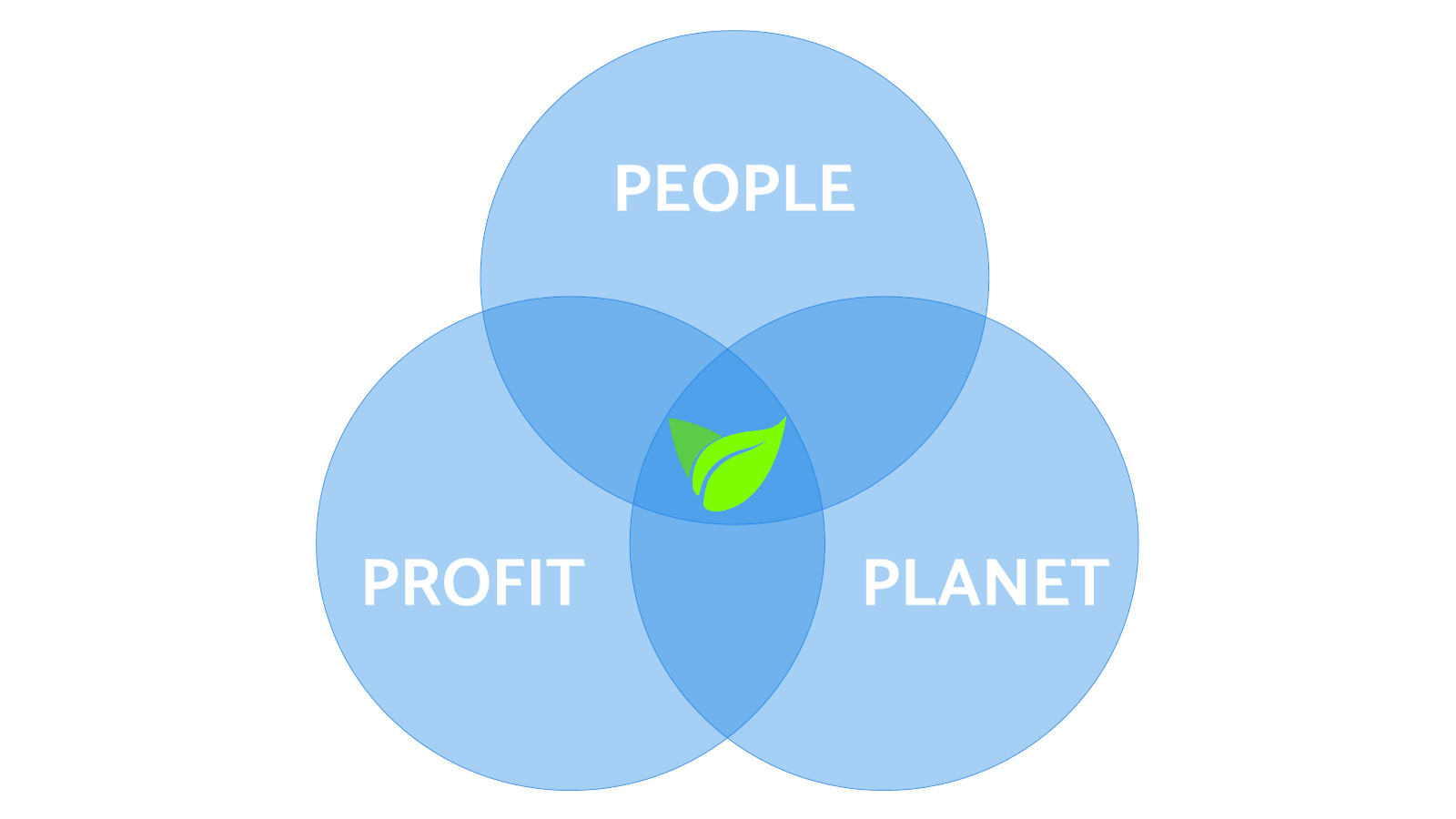

CB Bhattacharya, the H.J. Zoffer Chair in Sustainability and Ethics, summarizes this movement beautifully. He calls for a “triple bottom line” - “a symbiosis between people, planet, and profit.” AgroFides is the epitome of this ambition, of this new era. The Great Reset begins now, and we at AgroFides are up to the task.